As more and more Northern Virginians navigate their new Post-Covid work schedule, most are finding one common theme; the inevitable return to the office, or at the very least, a little tug. However, those who want to move closer to the office, or have decided that maybe living out in a cabin on the Shenandoah really wasn’t their thing after all are finding it hard to part with their newly acquired digs, due to one thing — Recording breakingly low interest rates.

The Era of Free Money

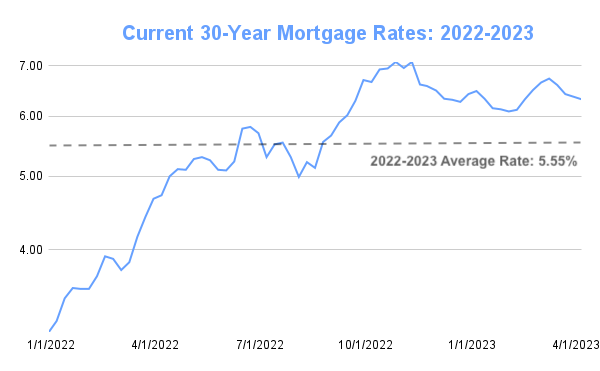

In fact, if you bought a new home before Spring of 2022, you probably bought it with an interest rate of less than 5% and much more likely somewhere in the neighborhood of 3%. This made prices shoot up during that time period (where they tend to stick in NOVA) but also made the mortgage payment for your home dirt cheap.

So if you took on a $700,000 mortgage with a 7% rate, your total monthly payment would be $4,657. But with the same size loan at a 4% rate, your monthly payment would be $3,342. Let’s say it’s a 3% rate with the same size loan, your monthly payment would be $2,951. It’s the golden-handcuffs of mortgage rates, and it’s keeping homeowners with low rates from selling.

The era of lower-than-ever mortgage rates is now long gone, and it’s been replaced with rates hovering around 7%, which is the historical average. Homeowners who are looking to move or make another Real Estate purchase are quickly realizing what a deal they got over the last few years. In fact, you don’t have to be an economist to know that holding on to a low interest rate is a smart financial move, so that’s just what homeowners are doing. Those who locked in these historically low interest rates before or during the Pandemic Housing Boom aren’t selling. In fact, a lot of them are becoming “Accidental Landlords,” simply because they don’t want to lose their low rates of the past.

The Accidental Landlord Boom

An Accidental Landlord is a term used to describe someone who didn’t set out to become a Landlord, but when confronted with a life change, such as relocating for a new job, or the need to upsize/downsize their current living situation decide it makes financial sense to turn that home into an incoming producing investment property.

The thought of becoming a Landlord is enough to stop even the most ardent do-it-yourselfer dead in their tracks ; dealing with demanding tenants, late rent, and state laws surrounding tenancy can be overwhelming. That’s why partnering with a great property management company is the smartest thing you can do to persevere your investment and maximize cash long term flow. Robert Kiyosaki, author of the famous book “Rich Dad, Poor Dad” puts it best when he states “A great Property Manager is key to success in Real Estate”.

Top 3 Benefits of Hiring a Property Manager

Get Back Your Time

When confronted with the notion of becoming a Landlord, step back and take a minute to think about your “Why”. Chances are your “Why” is not to be a full time manager of Rental Property. If it is, give us a call, we are always looking for talented people! Joking aside, your time is valuable.

If you are considering renting out your property then it’s likely you earn an income or salary doing something else that can be quantified on an hourly basis. Whatever that hourly number is, try to think about the number of hours you will spend being a property manager. Think about the physical hours you will spend going to the property, marketing the property, showing the property, meeting contractors, answering calls and emails from the tenant, etc.

Now think of all the mental time you will spend thinking about the property and educating yourself on how to be a Landlord. If it seems overwhelming, it’s because it is. In fact, it’s a full time job and you already have one of those!

Just like money, your quality time is an investment that compounds over time. Spend it doing the things you love, it will grow and become valuable! Spend it in the wrong places, it will be wasted and become stagnant.

Save your Money

Seems counterintuitive doesn’t it? If you are paying a management fee each month then how on earth could you be saving money?! To answer that question, see Warren Buffet’s 1st rule of Investing – “Never Lose Money”.

The fact is that any novice investor can try to spend as little as possible to keep costs down but true investing is about maximizing your returns and avoiding, as Keith Cunninham puts it in his book “the Road Less Stupid” the “Dumb Tax”.

The “Dumb Tax” is just a small fee you pay for not thinking things all the way through. Smart people do dumb things. Here’s the proof: How much money would you have right now if I gave you the ability to unwind any three financial decisions you have ever made? If you answered that question truthfully you know that there are many things in your life financially you wish you could take back and its cost you thousands! Limit your downside.

Dumb Decisions will cost you money. For Landlords this can mean a lot of things — paying too much for contractors, hiring cheap and poor quality contractors, avoiding rental property inspections, tenant damage, avoiding raising the rent because “you just are happy the tenant is staying”, not knowing the law and facing legal action, not marketing the property well and getting a bad tenant who doesn’t pay or worse, etc. You don’t have to think very long to start running through some bad scenarios.

Let us put it on a bumper sticker for you — “Don’t Lose Money, Hire an Expert.”

Apply Occam’s Razor

Life is funny sometimes. As humans, we can drive ourselves crazy trying to solve a problem. But solving them is usually simple. In fact, one of our favorite operating principles is Occam’s Razor.

If you are not familiar with Occam’s Razor, it states that answer to most problems is often the simplest, or to put it another way – the solution is often the one involving the fewest inputs. When you fully understand the concept you can apply it to many situations. It’s so useful that many top medical schools drive this method home to their first year Med students.

In Property Management it’s important to simplify your problem and choose…wait for it…RentSimple!

Why RentSimple is the ONLY Choice for Your Rental Property

RentSimple is a completely unique property management company. It goes beyond what a normal property management company does for their clients in many ways, but we will summarize here…

Full Rental Protection

RentSimple will fully guarantee the rent you are promised under your lease 100%. Therefore you can apply Warren Buffet’s rule we referenced earlier. In addition, they will also cover court costs and legal fees associated with an eviction. They take it one step farther to guarantee Pet Damage for all their plans and Tenant Damage on their Premier Plan. Check out all our Pricing Plans Here.

High End Marketing

To be fully committed to something means it’s the only thing you do and you do it well. RentSimple only does rentals in Northern Virginia. We do not dabble in sales, we don’t manage HOAs, that means we are experts in Rentals and Rentals only.

When you focus on something exclusively you can become great at doing it. We are experts in marketing our properties by partnering with local professional photographers and are a Zillow Premier Partner. Which means we get the top exposure and we showcase your rental property in the best light. Check out our Recently Rented Page and our YouTube Channel to see what we are talking about.

Local Reputation

To be in business for 15 years and have a perfect 5 Star Rating on Google says something about how you run your business and how you treat clients. This local reputation means that not only do we run a great operation, but also we attract high quality tenants.

High Quality tenants tend to stick around for the long term and take care of an investment property. For a Landlord this means more consistent income over a long period of time.

To See if RentSimple is a good fit to manage your rental property or to see how much your property will rent for, contact us today!